For most people, a house is the biggest purchase they make in their lifetime. But it’s so much more than a simple possession; it’s a home, a safe haven, the place you feel most comfortable, the place your children grow up.

Because of the high-dollar value, it also often forms a key piece of divorce settlements. Mortgages, home loans, interest, and all the other associated expenses also make it a difficult asset to deal with during the division of property.

What If One Spouse Owns A Home Before Marriage?

Married couples often buy a house together, as a single unit. But it also frequently happens that one spouse owns a home before tying the knot. This complicates matters down the line in cases of divorce.

One spouse may have purchased the home initially, though as a couple begins married life, both contribute to mortgage payments. So, what share of a property is an ex entitled to as a result of these contributions?

When you use community funds to pay down a property, this creates a community property interest. In cases of divorce, California uses a formula called Moore Marsden to determine if one spouse should receive any money due to their contributions.

Related Reading: Can I Move Out All Their Stuff and Change the Locks?

What Is Moore Marsden?

What Is Moore Marsden?

While it sounds like a person’s name, Moore Marsden is named after two Supreme Court cases from the early 1980s: In the re Marriage of Moore and Marriage of Marsden, an appellate case from 1982.

In the Marriage of Marsden case, a man made a down payment, secured a mortgage, and purchased a house. Over time, he paid down the principal on his home loan.

Down the road, he married, and the couple continued to make payments, using community funds. This couple ultimately split up. The wife moved out and the husband continued to make payments as usual.

The question that arose was whether or not the wife was entitled to a portion of the house based on the payments made during the marriage.

In short, the courts found that the wife was entitled to a percentage of the property. Had the husband continued to make payments from separate funds, that wouldn’t have been the case.

Also, the same usually goes for if the payments only cover interest. Payments don’t factor in unless they reduce the principal, even if the money came from the community.

The situation gets complicated since California follows community property guidelines. This means the state views all money earned by either spouse during a marriage as belonging equally to both. As one might imagine, this blurs the line between what is and isn’t separate property. It often takes work to untangle and clarify.

Related Reading: Can I Buy a House During a Divorce?

How Moore Marsden Works

Under California law, a spouse can seek reimbursement in divorce for one or both of the following:

- If their separate property added to the shared marital property.

- If community property contributed to the value of the separate property of one spouse.

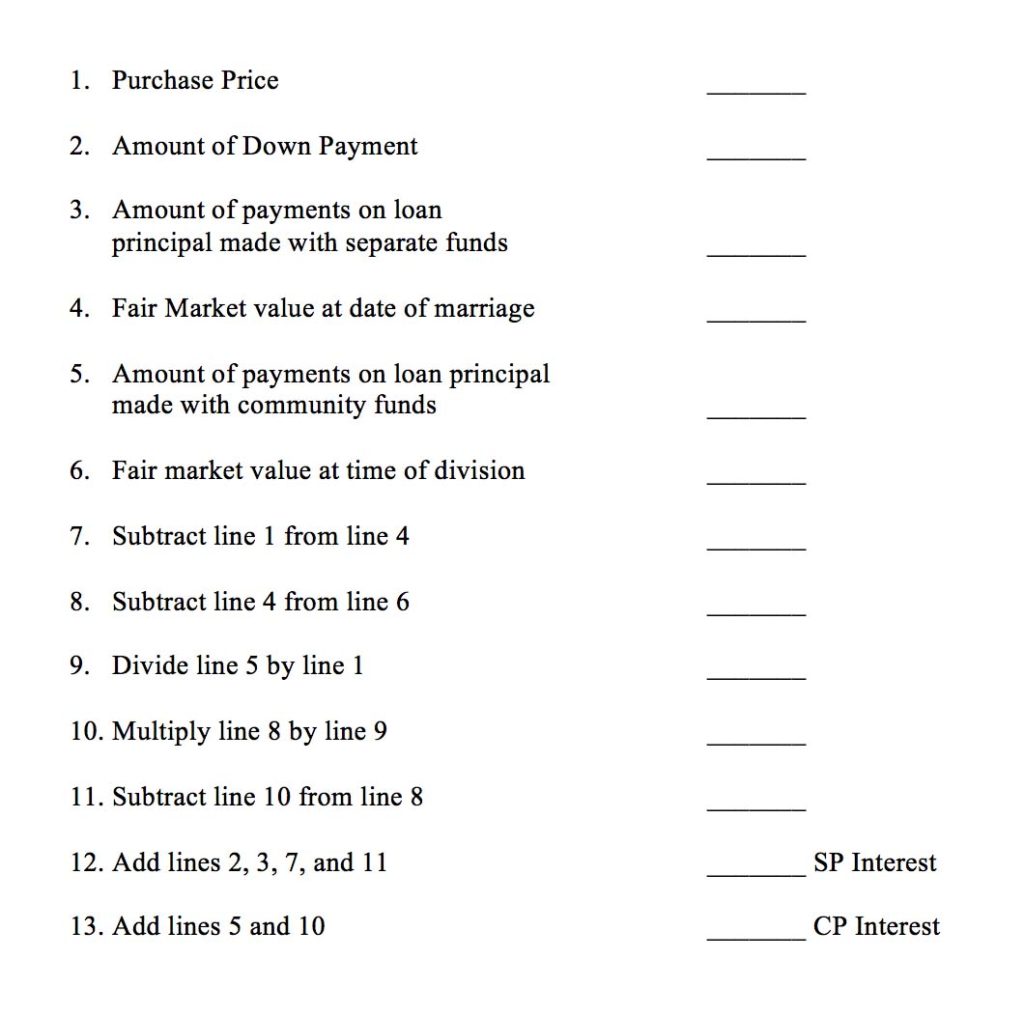

Courts use Moore Marsden to calculate how much of a stake one spouse has in the property. Much like child support, it follows a rigid formula. You fill in the variables and a number comes out. Not a lot of wiggle room.

Look at the worksheet below to see what goes into the process. You can also go here to find a Moore Marsden calculator. The number you come up with is not a set-in-stone, legally binding figure. It may, however, give you an idea of what to expect if you find yourself in this situation.

Related Reading: 8 Things You Should Never Do During Divorce

Moore Marsden Worksheet

This is a complicated formula that plays out something like homework. You have to account for the purchase price, down payment, increases in value, what was paid before marriage, what was paid after, and additional factors. The process becomes even messier if you refinance the mortgage or make significant improvements to the home.

The division of property is complicated enough, but when one spouse previously owned a home, it becomes even trickier.

Moore Marsden decisions help ensure you don’t overpay if you owned property before marriage or get underpaid if you contributed to decreasing the principal during.

Though intended as a protection, it’s also a convoluted formula. Most likely, it’s in your best interest to hire a divorce lawyer experienced in this type of case to guide you through.

Related Reading: How to Prepare for Your Initial Consultation with a Divorce Lawyer

Comments 4

GJ,

I’m currently on the tail end of a divorce and we will need this Process to finalize the House. My ex is getting two references as well as I. We will have to come to an agreement on who to use. I’d like to speak to someone about this

Author

Hi Ryan,

Thanks for reaching out. We’d love the chance to get more details about your case and let you know how we can help.

The best way to move forward is to call our office at (619) 243-0888. We can set up a free phone consultation with our managing attorney, Zephyr Hill. This gives us the chance to get more information and let you know what options you have.

There’s no charge and hopefully you’ll walk away with an idea of how best to proceed.

Additionally, you can fill out a free online case review by following this link and we will contact you directly: https://www.goldbergjones-sandiego.com/get-free-case-review/

Hope to hear from you soon!

The Goldberg Jones Team

My wife and I have separate checking accounts. She does not contribute to mine, but I pay all household expenses. I owned my home prior to marriage, paid it off and got a home equity loan to pay off my previous wife in 2005. I remarried in 2010. Is my current wife entitled to a share of my home? I made all payments on the home equity loan out of my own account.

Author

Hi Raul,

Thanks for the question. We can’t really get into the specifics here, but we’d love the chance to talk to you about your situation and discuss your options.

The best way to set up a consultation is to either call our office at (619) 243-0888 or fill out a case review at https://www.goldbergjones-sandiego.com/get-free-case-review/.

We can get something on the schedule, give you an idea of how best to proceed, and let you know how we can help get all of this sorted out.

Talk to you soon!